2 Dec 2010

Stronger, better second time round.

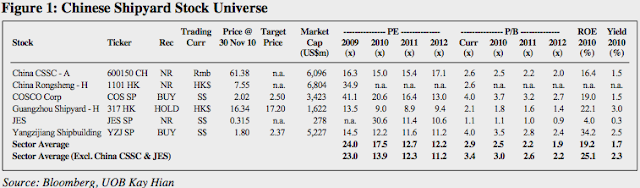

2010 marks the dawn of a new shipbuilding cycle and a second learning curve for Chinese shipyards, the first being the 2003-09 period during which they learned to build, in most cases, for the first time. Multi-skilled large Chinese yards will benefit from different product segments while meeting regional competition head-on. Our top stock picks are COSCO Corp (S) (COSCO (S)) (BUY/Target: S$2.50) and Yangzijiang Shipbuilding (Holdings) (YZJ) (BUY/Target: S$2.37).

Dawn of a new cycle.

Share prices of Chinese shipyards have rallied 45% on average in 2H10 (but still 65% below their peaks in 2007) in tandem with the recovery in global ship contracting (orders for new ships).

Containership orders, the next wave in ship contracting.

Of the three shipping segments − dry bulk, tanker and container − the container shipping segment is the most evenly keeled. YZJ, a leading builder of containerships with a good spread of European, American and Asian ship-owner customers, is our top stock pick to play the containership contracting wave.

Offshore fabrication – Slowly, but surely.

Chinese shipyards are gradually progressing from hull fabrication to turnkey projects. COSCO (S) is a good proxy to a global recovery in offshore oil & gas spending. As a testament to this, 70% of its total new contracts worth US$1.8b secured ytd are offshore contracts including FPSO conversions.

Size does matter.

Shipyards still have plenty of work in 2010 and 2011 from the large orderbooks secured prior to the global financial crisis. Shipyard overcapacity – particularly in China − will only be a major issue from 2012 onwards as new ship orders will not sufficiently offset the large ship deliveries in 2010 and 2011. We estimate shipyard utilisation will fall from 90% in 2010 to 50% by 2013. This will present opportunities for large Chinese shipyards to acquire smaller yards that have a strategic fit.

Nancy Wei. +65 6590 6628 nancy.wei@uobkayhian.com.

Lawrence Li. +8621 5404 7225

Friday, December 17, 2010

Friday, October 22, 2010

22nd October 2010 The Business Times

- Equity bubble, asset bubble in Asian Market in 12 to 18 months time (October - December 2011), without good economic growth.

- US creating more debt to deal with debt. Hedge funds are back to their stride, leverage buy-outs and private equity transactions are back. Japan's Quantitative Easing measures to print more money and effective devaluation of the yen. A Mercantilist behaviour before the Asian financial crisis. China holding back and not let its currency appreciate enough and handing on to its export-led and speculation-led model of growth instead of boosting domestic demand. All this contributes to global imbalance. Expect a 30% correction in stock markets.

- Excess speculative capital flushing around and although the markets have been quite strong the last four weeks, its likely only tip of the iceberg.

- Bullish on property, financial, energy commodities e.g oil because it is a lagging indicator. Should focus on rig builders and offshore structure builders because of more orders inflow incoming in.

- China's hike may hit some of S'pore listed firms

- Capitaland with 35% of its Revised Net Asset Value from China, risk a bigger fall out compared to its peers from policy risks in Chinese property market. Its 2 projects in Shanghai - the Pinnacle and Paragon, could be delayed for 6 months from October. However, Capitaland earnings should not be affected given its resilient retail portfolio.

- Kepland has 25% of its RNAV exposure to China, should be offset by its large exposure to the rebounding offices sector in Singapore.

- Yangzijiang shipping contracts are mostly in US dollars and its running cost in yuan terms. More than 90% of its shipping revenue is from overseas customer. It has some currency forwards to hedge currency fluctuations.

- Sino Grandness Food Industry Group will be affected with its avenue derived from overseas market.

- C&O Pharm and China Essence is likely to benefit since their borrowing/purchasing costs is likely to be more than offset by savings from US dollar for the former and US dollar and HK dollar for the latter.

- ComfortDelGro also has operations in China, the United Kingdom, Ireland, Australia, Vietnam and Malaysia. Currently, overseas ventures account for 50% of the company's revenue. China accounts for 13% of its EBIT.

China's rate hike may hit some S'pore listed firms

China Minzhong, Yangzijiang and CapitaLand may suffer fall-outs: DMG

By JAMIE LEE

CHINA'S surprise interest rate hike could hit companies such as CapitaLand, China Minzhong and Yangzijiang Shipbuilding, said DMG & Partners Securities in a report yesterday.The People's Bank of China said this week that it would raise benchmark rates by 0.25 percentage point, increasing the one-year deposit and lending rates to 2.5 per cent and 5.56 per cent, respectively.

With 35 per cent of its revised net asset value (RNAV) from China, CapitaLand risks a bigger fall-out compared to its peers from the policy risks in the Chinese property market, which could hurt the share price movement, DMG said.

DMG also noted that CapitaLand's two planned launches in Shanghai - The Pinnacle and Paragon - could be delayed from the initial launch period that is six months from October.

'The unexpected rise in Chinese interest rates, coupled with our prognosis of an upcoming trial property tax, points to policy risks within the broad Chinese real estate sector that are not receding,' DMG said.

'This will continue to cap share-price upside.' But DMG noted that CapitaLand's earnings should be less affected, given its resilient retail portfolio.

By comparison, impact on Keppel Land - which has a 25 per cent RNAV exposure to China - should be offset by its large exposure to the rebounding office sector in Singapore, DMG said.

Earnings of vegetable producer China Minzhong could notch lower as a stronger yuan puts pressure on its export sales.

DMG said that China Minzhong's export sales make up 68 per cent of the group's revenue for the 12 months ended June 2010.

'While China Minzhong has been able to mitigate most of its foreign exchange risks by selling through China-based export distributors, any sudden surge in the yuan could adversely affect demand from the USA and Europe, its main export markets.'

In response, a company spokeswoman said that for fiscal 2010, just 17 per cent of the group's sales were denominated in foreign currencies. Because contracts are signed annually, the company has the flexibility of pricing in yuan appreciation if required, she added.

Also taking some heat was Yangzijiang, which could be hit by a stronger yuan since it takes in shipbuilding contracts that are typically in US dollar terms, but stomachs most of its costs in yuan terms.

Yangzijiang's fiscal 2009 annual report said that the Chinese shipbuilder holds currency forwards to hedge 'highly probable forecast revenues denominated in US dollars'.

DMG sees some positive impact for China Essence and C&O Pharmaceutical.

China Essence's higher borrowing costs is likely to be more than offset by savings from US dollar and Hong Kong dollar-denominated debts, while C&O Pharmaceutical could expand its gross margins since cost of purchase for its exclusive products are made with the US dollar.

Asian bubble ahead in 12 to 18 mths: RBS

By LYNN KAN

IN the next 12 to 18 months, investors should see a bubble in Asian equity prices, but one that will not be supported by similarly rosy news of economic growth, says RBS' head of regional strategy Emil Wolter. | Mr Wolter: Few of the debt-ridden advanced economies have bitten the bullet and cut debt |

'A natural consequence of zero interest rates and lots of easy money is that investors will face an environment in the next 12 to 18 months that will be much more about multiple expansions than it is about cash flow growth and earnings,' he says. 'It'll be about paying a higher price for pretty much the same thing instead of the market going up in line with earnings.'

He observes that few debt-ridden advanced economies have actually bitten the bullet and cut debt, save for Ireland and the UK. 'The US is back to creating more debt to deal with debt. Hedge funds are back in their stride, leverage buy-outs and private equity transactions are back. It's been a clear U-turn,' he says.

Japan, too, has added to global imbalances with the printing of more money and effective devaluation of the yen. 'This has been a fantastic excuse for other central banks in Asia also to revert back to mercantilist behaviour that they had been showing since the Asian Financial Crisis.'

At the same time, China has firmly not let its currency appreciate enough despite depegging it from the dollar, hanging on to its export-led and speculation-led model of growth instead of boosting domestic demand.

The maelstrom of policy reversals has led him to revise his expectations of a 30 per cent correction in the Asian stock markets. Instead, he predicts an asset bubble forming in the next 12 to 18 months.

'It's likely to form because emerging markets have the basic necessities for a bubble forming. There's a good fundamentals story and, of course, there's a lack of better alternatives anywhere else. There's excess speculative capital flushing around and although the markets have been quite strong the last four weeks, it's likely only the tip of the iceberg,' Mr Wolter says.

Though the Chinese government has raised interest rates this week to curb domestic inflation, he believes Asian stock markets will not be halted in their ascent.

'I see little impact. The cost of capital is much less important than the availability of capital. On average, higher interest rates are bullish to the financial sector through an expansion in net interest margins or investment yields to insurance companies. What does impact the market is the increase in money supply - which is happening and that I see climbing to 20 to 25 per cent over the next four months - that will set the Asian stock markets on fire.'

In fact, the Chinese and Singapore property markets - two countries whose governments have imposed property price curbs - are sectors he's bullish on. He names Soho China and Guangzhou R&F as examples.

He's also overweight on the financial sector in Singapore, Thailand and Taiwan, choosing OCBC, NAB, ChinaTrust and Bangkok Bank.

Energy commodities are good plays in his opinion, in particular oil, because 'it's lagging other commodities'. 'Investors should also focus on rig builders and offshore structure builders because we see order flows coming in,' he says.

In terms of countries, he is overweight on China, Singapore, Malaysia and New Zealand. Indonesia, India, the Philippines and Australia are, however, countries he's underweight on in Asia.

Ultimately, investors can ride a bubble for the near-term, but in the long-run the need for global rebalancing remains the elephant in the room even as policy reversals take place.

Subscribe to:

Comments (Atom)