2 Dec 2010

Stronger, better second time round.

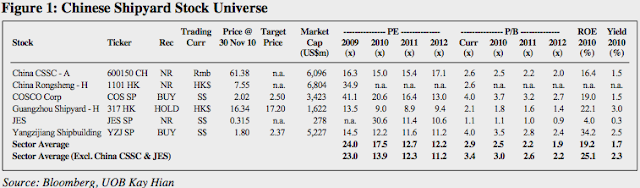

2010 marks the dawn of a new shipbuilding cycle and a second learning curve for Chinese shipyards, the first being the 2003-09 period during which they learned to build, in most cases, for the first time. Multi-skilled large Chinese yards will benefit from different product segments while meeting regional competition head-on. Our top stock picks are COSCO Corp (S) (COSCO (S)) (BUY/Target: S$2.50) and Yangzijiang Shipbuilding (Holdings) (YZJ) (BUY/Target: S$2.37).

Dawn of a new cycle.

Share prices of Chinese shipyards have rallied 45% on average in 2H10 (but still 65% below their peaks in 2007) in tandem with the recovery in global ship contracting (orders for new ships).

Containership orders, the next wave in ship contracting.

Of the three shipping segments − dry bulk, tanker and container − the container shipping segment is the most evenly keeled. YZJ, a leading builder of containerships with a good spread of European, American and Asian ship-owner customers, is our top stock pick to play the containership contracting wave.

Offshore fabrication – Slowly, but surely.

Chinese shipyards are gradually progressing from hull fabrication to turnkey projects. COSCO (S) is a good proxy to a global recovery in offshore oil & gas spending. As a testament to this, 70% of its total new contracts worth US$1.8b secured ytd are offshore contracts including FPSO conversions.

Size does matter.

Shipyards still have plenty of work in 2010 and 2011 from the large orderbooks secured prior to the global financial crisis. Shipyard overcapacity – particularly in China − will only be a major issue from 2012 onwards as new ship orders will not sufficiently offset the large ship deliveries in 2010 and 2011. We estimate shipyard utilisation will fall from 90% in 2010 to 50% by 2013. This will present opportunities for large Chinese shipyards to acquire smaller yards that have a strategic fit.

Nancy Wei. +65 6590 6628 nancy.wei@uobkayhian.com.

Lawrence Li. +8621 5404 7225